[ad_1]

For two days in a row, the bears succeeded in stabilizing the price of the GBP/USD currency pair below the 1.3000 psychological support, with losses to the 1.2982 support level. It settled around the 1.3030 level at the time of writing the analysis. In general, the price of the pound sterling stopped in its recent recovery last week. It may now be exposed to the risk of a relapse as the pound moves through a series of economic data risks, and in return, the euro is likely to benefit from the French political developments and the central bank’s policy decision. The US dollar may move stronger than the inflation figures, which may support further tightening of the Fed’s policy.

At the beginning of this week’s trading. Britain’s economic growth slowed in February amid a decline in the production of cars, computers and chemicals. The Office for National Statistics said Britain’s gross domestic product increased just 0.1% from the previous month, down from 0.8% in January. Output of productive industries, including manufacturing, mining and power generation, fell 0.6% in the month. Construction work was down 0.1%. These declines were largely offset by an increase in service industries, led by an 8.6% jump in accommodation and food services. The Office for National Statistics also said monthly GDP is now 1.5% higher than pre-pandemic levels. While service production is 2.1% higher compared to February 2020. The construction sector is up 1.1%, while manufacturing and production are down 1.9% from pre-pandemic levels.

Service industries account for about 80% of the UK’s economic output.

The British pound was negatively affected in forex trading by uncertainty over the Bank of England’s interest rate policy outlook after the Bank of England cited inflationary pressure to enter in March as a possible partial equalizer for additional bank rate increases later this year. The Bank of England has raised its bank rate three times since December but raised doubts about whether it will be raised further in the short term, which could prevent sterling from benefiting if Wednesday’s UK inflation data surprises to the upside of market expectations.

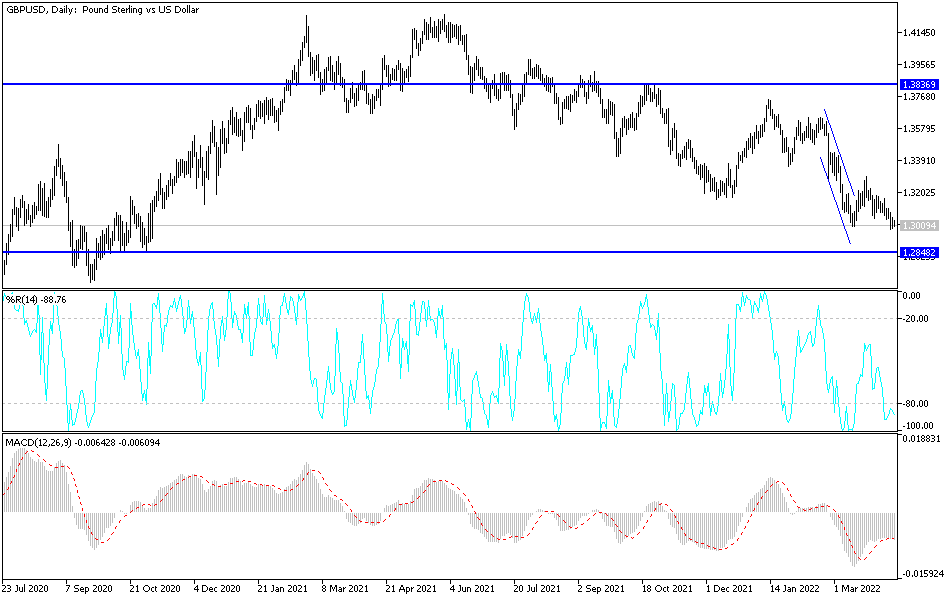

According to the technical analysis of the pair: The price of the GBP/USD currency pair moved with its recent losses in technical indicators towards oversold levels, especially in the event of stability below the 1.3000 psychological support level. This may encourage the bears to move further downwards and does not rule out moving towards the 1.2680 support level. . On the other hand, according to the performance on the daily chart, the bulls should move towards the resistance level 1.3335, to be an opportunity to abandon the current stronger downward trend.

In terms of economic calendar data today, the details of jobs and wages numbers in Britain will be announced first, then the most important US inflation numbers will be announced through the Consumer Price Index.

[ad_2]