[ad_1]

I do have more of an upward bias, but I also recognize that things can change in a flash.

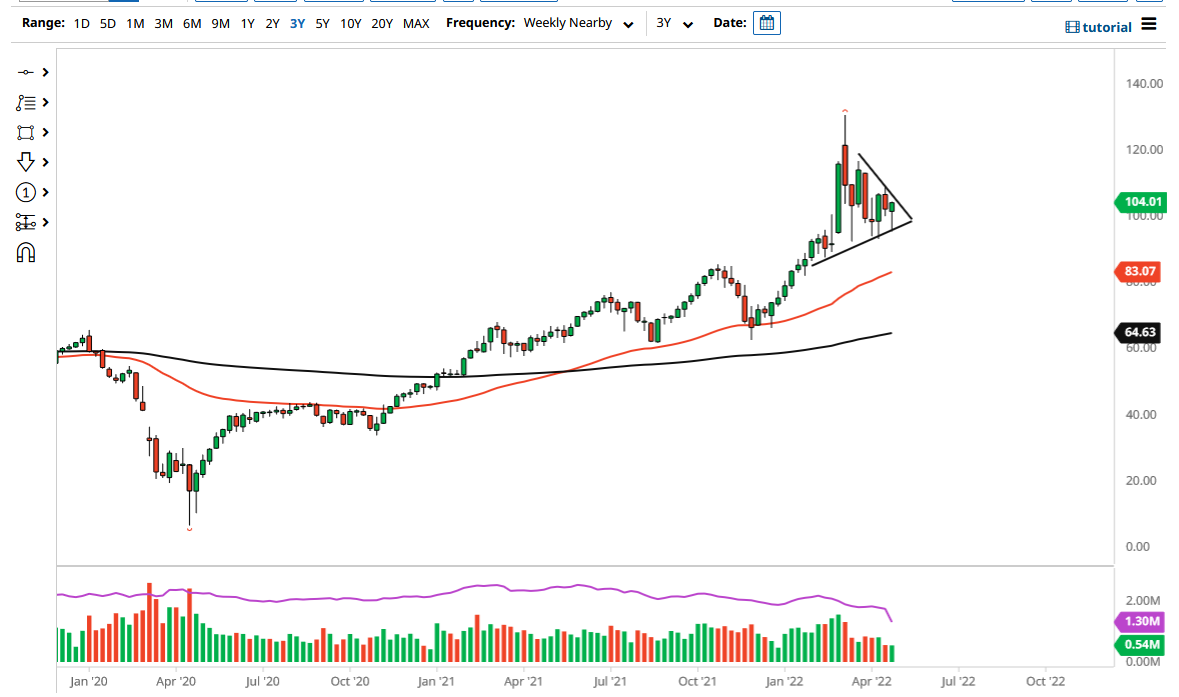

The West Texas Intermediate Crude Oil market has been very tight during the month of April, and it now looks as if we are trying to build up enough momentum to make a bigger move. It is worth noting that the uptrend line of the triangle is still very much intact, so you should pay close attention to it. It is as if the market is trying to determine whether or not the demand is going to overwhelm supply or vice versa. After all, there are a lot of moving pieces when it comes to the global economy at the moment.

Oil prices are making great trade opportunities

It is worth noting that we are just above the $100 level, and that of course has a certain amount of psychology attached to it. As long as we can stay above the $100 level and that uptrend line that I have plotted on this chart, then it is difficult to imagine shorting this market. If the market takes out the $110 level, it is very likely that we will have a significant amount of momentum building up for the buyers, and therefore could allow the market to go looking towards the recent highs, which is closer to the $130 level.

However, if we start to see the global economy slow down enough to cause demand concerns, then it is possible that we could break down below the uptrend line. If we do, then it opens up a move down to the $90 level, possibly even down to the 50 Week EMA which is currently at the $83 level. This would more likely than not be based upon the idea of the global economy falling apart, which obviously is something that is a major concern now that China continues to lock things down. However, it is probably worth noting how strong the market has been behaving in the face of half of China being shut-in.

With all this being said, I do have more of an upward bias, but I also recognize that things can change in a flash. Because of this, I will continue to use the triangle as a guideline as to where we go next, understanding that volatility is probably the only thing that we are going to see on a constant basis, so position sizing and stop loss placement will be crucial.

[ad_2]