[ad_1]

Fading short-term rallies will more than likely continue to be the best way going forward, as we will have plenty of supply above at this point.

The US dollar fell against the Brazilian real on Tuesday as we have broken below the 5.00 BRL level. That being said, the Brazilian real is a little bit different than most other currencies against the greenback, because higher interest rates in Latin America and the reopening of trade in the region have been very strong. Furthermore, soft commodities continue to strengthen so it takes quite a bit of momentum into the currency.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

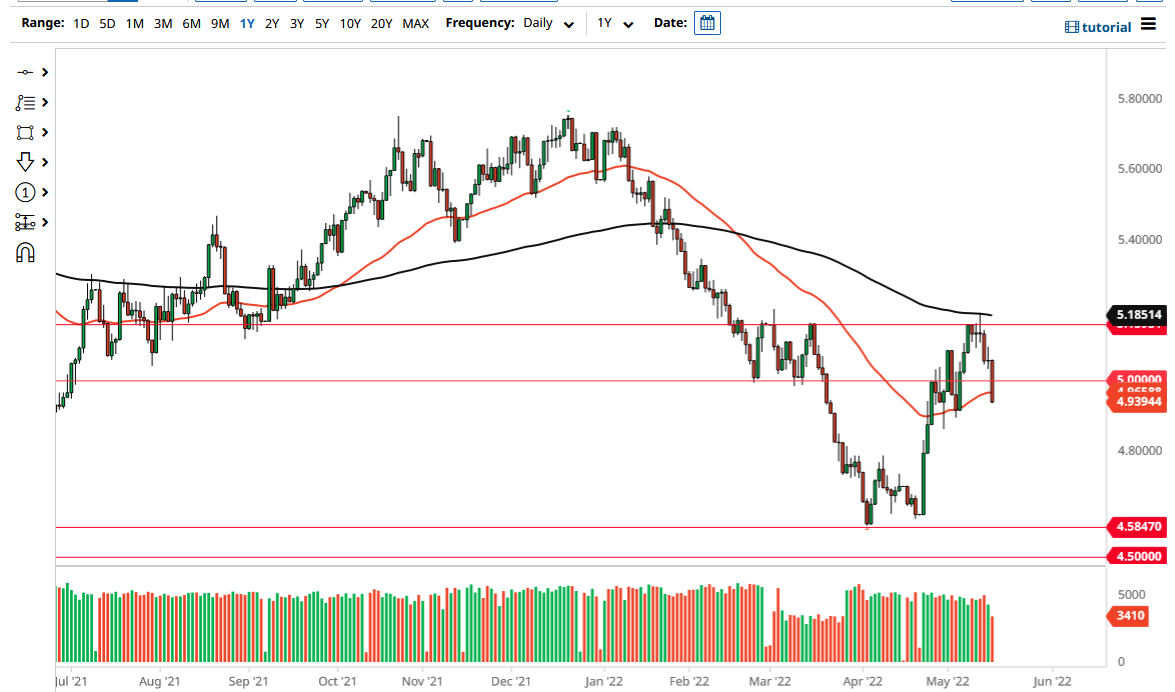

At this point, the market is threatening to break significantly below the 50-day EMA, and if it does, then it is likely that we would go to the 4.80 level, maybe even the 4.60 level after that. The candlestick is rather negative looking, and the fact that we ended up forming a shooting star right at the 200-day EMA several sessions ago suggests that we have pulled back quite nicely, and found enough of a reason to continue the overall downtrend. Ultimately, this is a market that would have to pull some type of Herculean effort to turn things around. If we were to break above the 200-day EMA, then it is a very bullish sign, and it could open up the possibility of the US dollar screaming higher. However, we would probably need to see some type of commodity selloff when it comes to food, something that does not look likely to happen anytime soon.

Fading short-term rallies will more than likely continue to be the best way going forward, as we will have plenty of supply above at this point. That being said, keep in mind that the global slowdown could come into the picture, so I would anticipate that we would have a lot of concern every time we do get a little too out-of-control in one direction or the other, so keep your position size reasonable but recognize that the Brazilian real does tend to trade in long trending patterns, so I am much more comfortable shorting that I am buying. If we do break above the 200-day EMA, then I will slowly build a position, not necessarily jump “all in” right away. The market breaking below the 4.50 level could be a runaway trade, but right now we are nowhere near doing that.

[ad_2]