[ad_1]

Despite raising US interest rates at a larger pace than expected the price of the US dollar against the Japanese yen (USD/JPY) currency pair experienced selling, as it lost more than 200 pips during yesterday’s trading session only. The currency pair fell from the resistance level of 135.58, the highest in 24 years, to the level of 133.50 before settling around 134.00 in the beginning of trading. In an effort to combat high US inflation, the Federal Reserve yesterday announced the largest increase in US interest rates in nearly thirty years. The Federal Reserve revealed that it decided to raise the target rate for the federal funds rate by 75 basis points to 1.50 to 1.75 percent, marking the largest rate hike since 1994.

The widely expected move by the Federal Reserve comes as a recent report from the Labor Department showed US consumer price inflation at the fastest annual rate in forty years.

Citing its goals of maximum employment and 2 percent inflation over the long term, the Fed also indicated that additional rate hikes would likely be appropriate. The Fed also said it will continue to reduce its holdings of Treasury securities, agency debt and agency mortgage-backed securities.

In its assessment of the US economy, the Fed said that overall economic activity appears to have rebounded after declining in the first quarter. The central bank described recent job gains as “strong” and noted that the unemployment rate remains low.

“Inflation remained elevated, reflecting pandemic-related supply and demand imbalances, higher energy prices, and broader price pressures,” the Fed said in its policy statement. However, the decision to raise rates by 75 basis points was not unanimous, as Kansas City Fed President Esther George preferred to raise rates by 50 basis points.

The Fed’s next monetary policy meeting is scheduled for July 26-27.

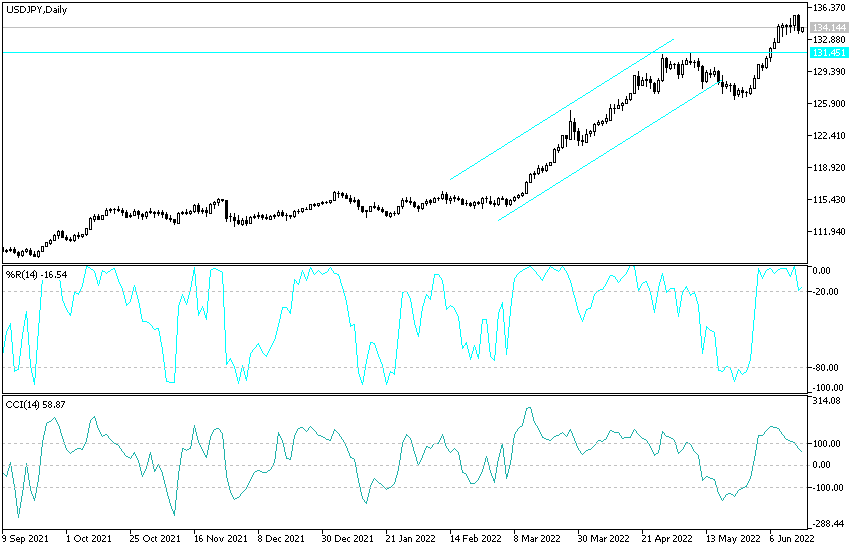

According to the technical analysis: USD/JPY has formed higher bottoms and higher tops on the hourly chart, creating a bullish channel pattern that may hold even after the FOMC decision. The price is approaching the support, which is aligned with the 100 SMA dynamic inflection point. So far, the 100 SMA is still above the 200 SMA to confirm that the general trend is still to the upside and that the support is more likely to continue than broken. In this case, USD/JPY could bounce back to the top of the channel around 136.00 or the important mid-channel area at 135.50.

Note, however, that the gap between the moving averages is narrowing to reflect a slowdown in upward pressure. Stochastic is also heading lower to show that sellers are in control at the moment i.e. until the oversold conditions are met. The RSI has more room to go lower before indicating oversold levels, so sellers can stay in control for a while. A break below the channel bottom around the minor psychological mark 134.50 may trigger a bullish reversal.

[ad_2]