[ad_1]

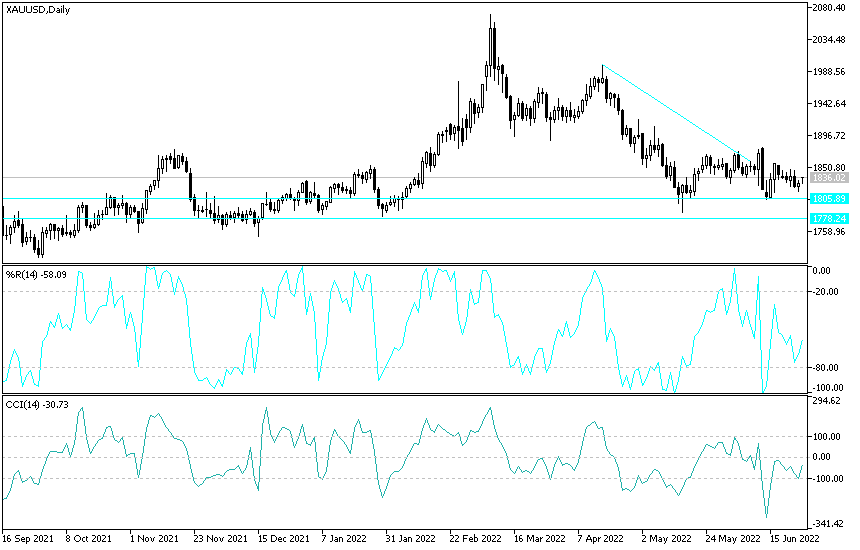

Gold futures snapped a four-day losing streak and settled slightly higher at the end of last week’s trading, as the US dollar gave up some of its strength. Treasury yields fell amid a slight decline in inflation concerns. The price of gold XAU/USD today around the level of 1837 dollars an ounce and the selling operations last week pushed it towards the support level of 1817 dollars an ounce.

On the economic front, data from the Commerce Department showed a significant recovery in US new home sales in May. The report showed new home sales rose 10.7% to an annual rate of 696,000 in May after declining 12% to an upwardly revised 629,000 in April. The surprise rise surprised economists who had expected US new home sales to decline 0.5 percent to an annual rate of 588 thousand from 591 thousand originally reported for the previous month.

Meanwhile, a separate report from the University of Michigan showed that US consumer confidence fell slightly more than initially expected in June. The report showed that the Consumer Confidence Index for June was revised down to 50.0 from an initial reading of 50.2. The Consumer Confidence Index fell sharply from the final reading for May of 58.4, falling to an all-time low. The sharp decline in the headline index came as the current economic conditions index fell to 53.8 in June from 53.3 in May, while the consumer expectations index fell to 47.5 from 55.2.

Today’s XAU/USD Gold Forecast:

Despite today’s recovery, however, the price of gold is subjected to downward pressure, and I still prefer to buy XAU/USD gold from every bearish level. The ongoing and increasing global geopolitical tensions still support the opportunity to buy gold in the end. The closest buying levels most appropriate to the last performance are 1817, 1800 and 1785 dollars, respectively. On the other hand, the price of gold may come out of the control of the last bears if it returns to move towards the resistance levels of 1855 and 1877 dollars, respectively.

The price of gold will be affected today by the price of the US dollar and the extent of investors’ appetite for risk or not, as well as the reaction from global central banks’ signals towards the future of tightening their monetary policy.

[ad_2]