[ad_1]

The Dow Jones Industrial Average Index continued to rise during its recent trading at the intraday levels, to achieve gains for the fifth consecutive day, by 0.71%. It added to it about 239.57 points, and settled at the end of trading at the level of 34,152.02. to close the index at its highest level since late April/ April, after rising 0.45% during trading on Friday.

Current volatility is making great stock trading opportunities – don’t miss out!

Walmart (WMT) was the strongest performer on the Dow, with the stock up 5.1% at the close, after the company said it no longer expects a significant decline in profits during fiscal year 2023. It also announced second-quarter results that topped estimates driven by a rise Prices and lower supply chain costs.

In addition, Home Depot’s second-quarter financial results topped Wall Street views as demand for home improvement remained strong despite the inflationary environment, while the retailer reiterated its full-year outlook, and the company’s shares jumped 4.1% to be also among the top gainers among companies. listed on the indicator.

Economic Data Outlook

US industrial production rose 0.6%, compared to expectations for a 0.3% increase in a Bloomberg survey and after a flat reading in June, capacity utilization rose to 80.3% from 79.9%, compared to guidance, which rose to 80.2%.

Housing starts fell 9.6% in July to an annual rate of 1.446 million units, the lowest since February 2021 and below market expectations of 1.54 million, according to the US Commerce Department.

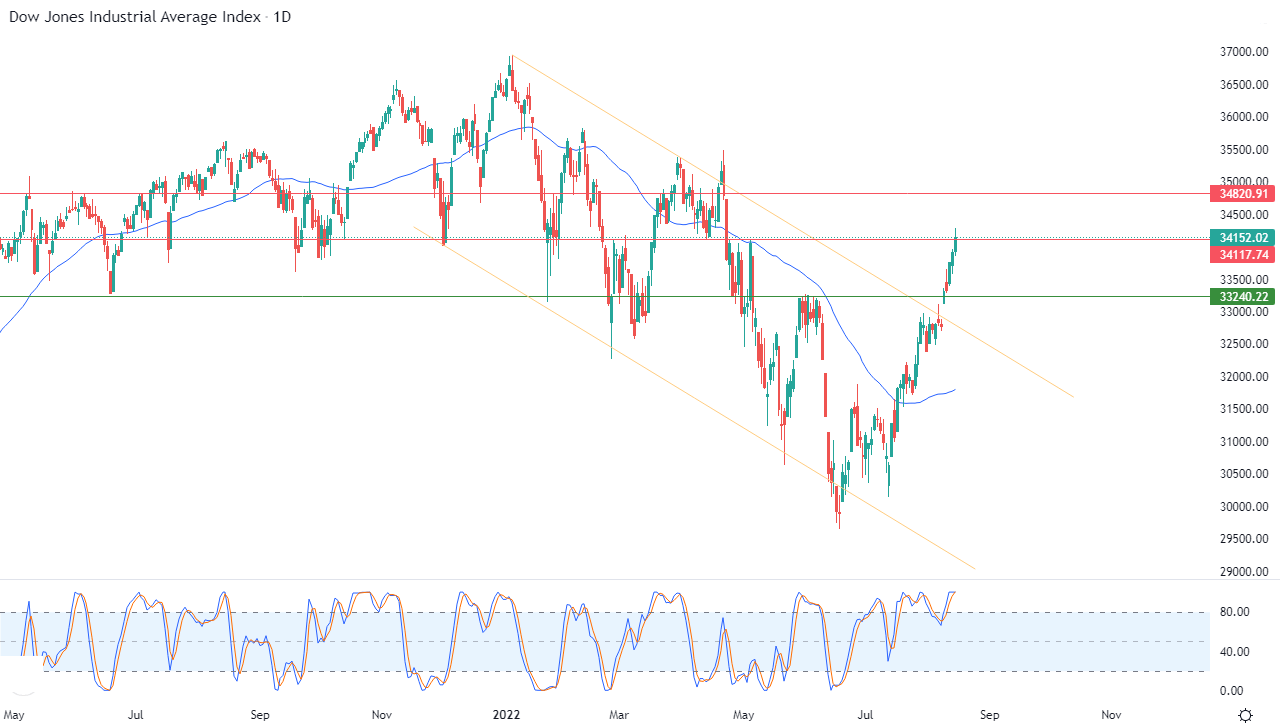

Technically, the index continues to rise amid being affected by the positive support provided due to its trading above its simple moving average for the previous 50 days. This is light of its exit from the range of a bearish corrective price channel that limited its previous trading in the short term. This is shown in the attached chart for a (daily) period, reaching In its recent trading to attack the resistance level 34,118.

We notice the start of a negative crossover on the RSI, after reaching overbought areas, which may curb the index’s upcoming gains, especially in the event that the resistance level 34,118 remains intact.

Therefore, we expect more rise for the index during its upcoming trading, but on the condition that it first overcome the resistance obstacle 34,118, and then target the resistance level 34,820.

Ready to trade the Dow Jones in Forex? Here’s a list of some of the best CFD brokers to check out.

[ad_2]