[ad_1]

Since the start of this week’s trading, the price of EUR/USD has been subjected to strong selling operations. As a result, it pushed towards the support level of 1.0122 before settling around the level of 1.0166 at the time of writing the analysis. The markets were strong with the announcement of the growth rate of the euro zone economy, then the announcement of the US retail numbers. The most important factor for the current market strength is the content of the minutes of the last meeting of the US Federal Reserve.

Analysts say that the recent developments in the energy markets in the Eurozone maintain the case for further depreciation of the Euro. Accordingly, the single currency in the Eurozone extended below the recent highs against the dollar and the British pound due to energy market developments which showed the European standard energy prices rising above €500 for the first time.

The developments threaten to put more pressure on businesses in the region in the coming months.

German energy for next year rose 5.2% to 502 euros/megawatt-hour on the European Energy Exchange on Tuesday. This represents a 500% increase in the last year. Commenting on this, Ole S Hansen, commodities analyst at Saxo Bank, says the EU’s gas and energy situation continues to deteriorate with the euro suffering as a result. European gas prices continued to rise as European countries continued to put pressure on demand in order to fill storage tanks before winter, amid continued pressure on supplies from Russia.

The European Gas Index – the TTF – rose 6.5% to its highest intraday price since early March.

Costs will rise at gas power plants in the eurozone, but electricity prices are under greater pressure due to lower production from nuclear power plants in France amid low river water levels and maintenance issues. Energy imports from Scandinavia have also been threatened by low levels of hydroelectric dams. An anticipation of suboptimal economic output is likely to further deteriorate the eurozone’s current account position, according to economists. The current account, the eurozone’s bank balance with the rest of the world, fell into a deficit in 2022 amid rising import costs and falling exports.

Euro forecast against the dollar:

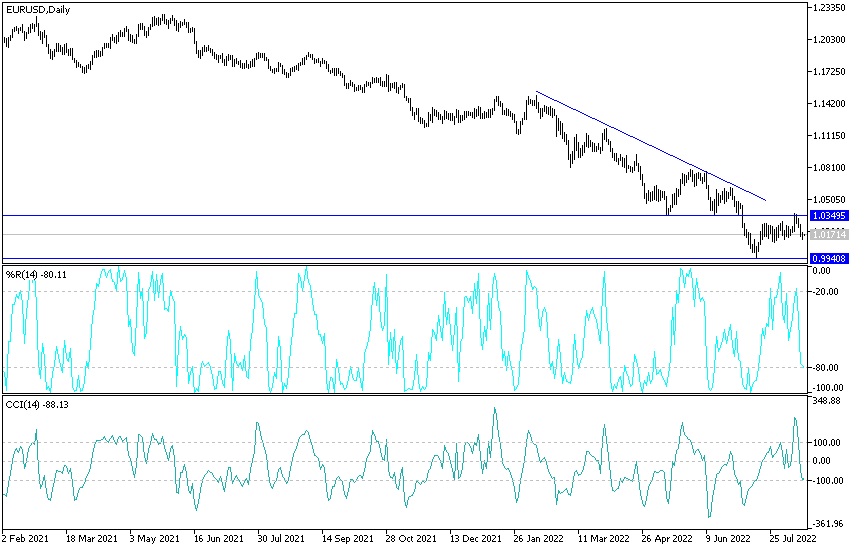

There is no change in my technical view of the performance of the EUR/USD currency pair.

- The reaction of economic data and important events will have a strong impact on the currency pair for the remainder of this week’s trading.

- We still expect EUR/USD gains to remain a selling target as divergence in economic performance and the future of monetary policy tightening remain ultimately in favor of a stronger US dollar.

- According to the current performance, breaking the support 1.0120 will support expectations of moving towards the parity price and below it. On the other hand, according to the performance on the daily chart below, the movement of the bulls towards the resistance levels at 1.0320 and 1.0400 will be important to change the general trend to the upside.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]