[ad_1]

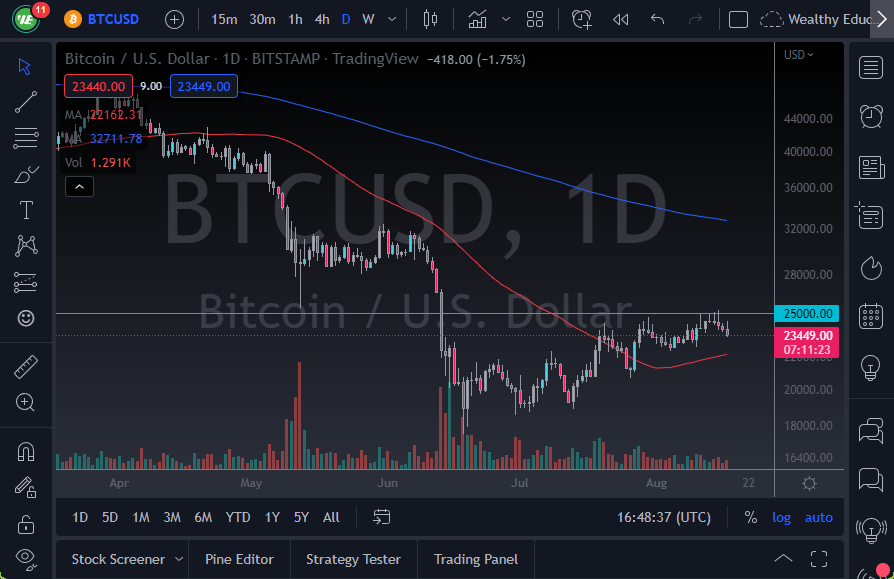

This is a situation where we have seen a nice recovery, but at this point, we are still very much in a downtrend.

- The Bitcoin market had initially tried to recover during the trading session on Wednesday.

- It then gave back gains to show signs of exhaustion.

- The Bitcoin market has been relatively positive for a while, but Bitcoin does not work by itself and lives in a vacuum.

The $25,000 level above continues to be difficult, and therefore I think if the market were to pay close attention to that level as we have been for a while, it does make a certain amount of sense that we have seen a lot of trouble yet again. In fact, I believe that the $25,000 level might end up being the top, but we will have to wait and see what the bond market does. This is because Bitcoin does not work outside of the rest of the financial world anymore. After all, there has been a lot of institutional money flying into the market, which has been good for the price previously, but it also means that Bitcoin will start to act like a more mature financial asset.

The shape of the candlestick is a bit of a shooting star, and therefore it shows that exhaustion may continue to be a problem. The 50 Day EMA sits below current pricing, near the $23,434 level, and is rising. You need to pay close attention to the bond market, because the yields rising will make a negative environment for risk appetite, and then by extension some of these more volatile assets such as cryptocurrency. This is what happens when the big players enter a market.

However, the Federal Reserve and other central banks are going to be meeting in Jackson Hole next week, and it’s possible that we could see the central banks try to talk down the markets going forward. This is a situation where we have seen a nice recovery, but at this point, we are still very much in a downtrend. If we break down below the 50-Day EMA, then it’s possible that the market could go down to the $20,000 level at that point, as it is a large, round, psychologically significant figure, and makes for a nice target. On a breakout above the $25,000 level, the next major resistance barrier is found at the $28,000 level.

Ready to trade Bitcoin USD? Here are the best crypto brokers to choose from.

[ad_2]