[ad_1]

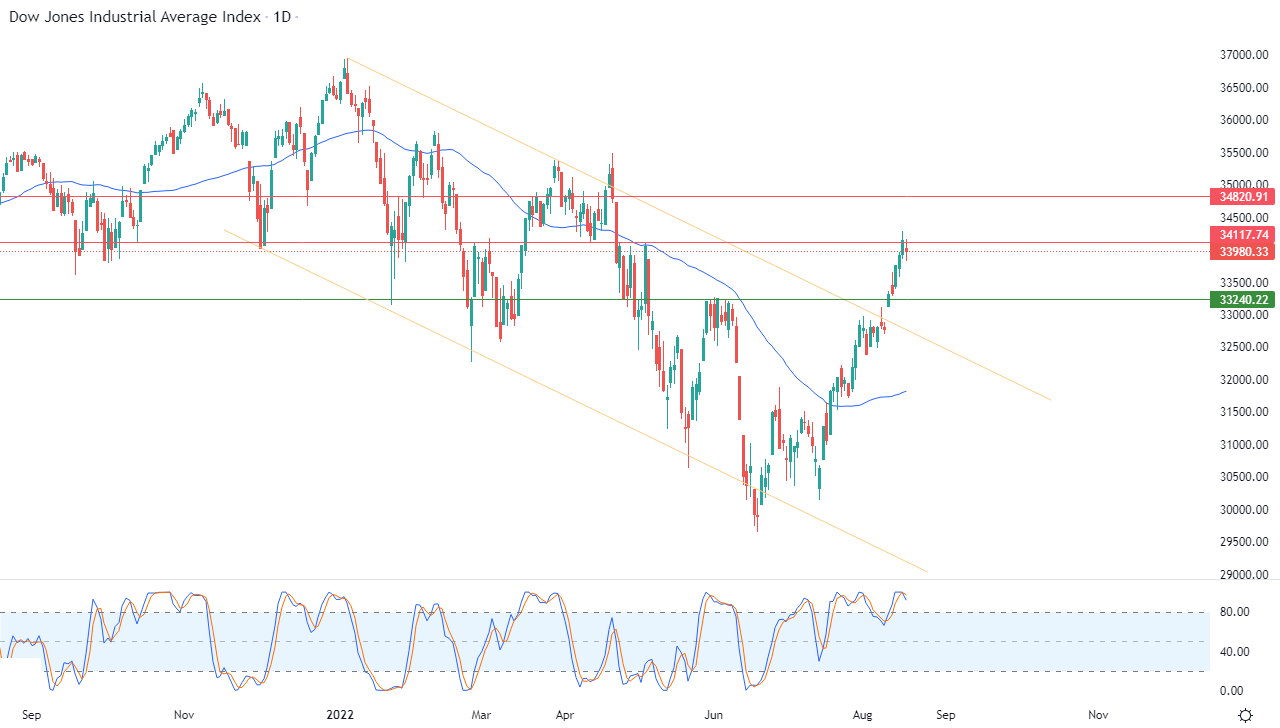

The Dow Jones Industrial Average declined during its recent trading at the intraday levels, to break with a series of gains that continued for five consecutive sessions. It recorded losses in its last sessions by -0.50%, to lose the index towards -171.69 points. It then settled at the end of trading at 33,980.33, after rising in trading on Tuesday, by 0.71%, to reach this rise to its highest level since late April.

Minutes released from the minutes of the Federal Reserve’s July meeting showed that members of the Federal Reserve’s Monetary Policy Committee decided at their meeting last month that they would continue to increase benchmark lending rates until inflation fell significantly. They are using incoming macroeconomic data to determine how high rates will go.

In an effort to combat hot inflation, the Federal Open Market Committee has raised interest rates at each of its meetings since March, including two back-to-back increases of 75 basis points at its last two meetings, with more increases expected in upcoming meetings. However, despite these measures, inflation remains at its highest levels in four decades.

Economic Outlook

US retail sales were flat in July, less than an expected 0.1% increase in a Bloomberg poll and after a 0.8% rise in June. However excluding a 1.6% drop in auto sales, retail sales rose 0.4%, compared to an expected drop of 0.1%. Gas station sales fell 1.8% in July, due to lower prices.

Dow Jones Technical Forecast

- Recent decline in the index came as an attempt to reap the profits of its recent rises.

- It is also trying to drain some of its clear buying saturation with the relative strength indicators.

- This is especially with the start of negative signals from them, to gather its positive forces that may help it recover and rise again.

- The index has helped in the resistance level 34,118 to remain intact.

Continued positive support for its trading above its simple moving average for the previous 50 days is being affected by the earlier exit from the range of a bearish corrective price channel that had limited its trading before in the short term, as shown in the attached chart for a (daily) period.

Therefore, our expectations suggest a return to the index’s rise during its upcoming trading, but it must first cross the resistance hurdle 34,118, and then target the resistance level 34,821 immediately.

Ready to trade the Dow Jones 30? We’ve shortlisted the best CFD brokers in the industry for you.

[ad_2]