[ad_1]

Markets acknowledged widespread signs that the US economy is slowing. This is despite a clear warning against assumptions that the Federal Reserve could push back on raising interest rates further or start cutting them at some point in the first months of the new year.

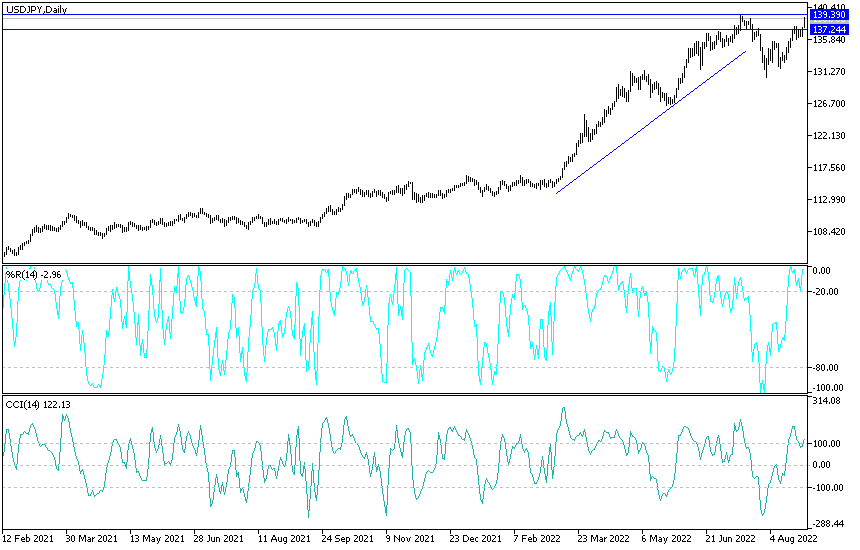

The trading week, in which the bulls dominated the direction of the USD/JPY pair, ended with gains, crossing the resistance level of 137.70 and closing stable around the resistance of 137.50.

This gave back to the markets the momentum for the possibility of moving towards the next psychological resistance of 140.00. The US dollar gained more momentum from the hawkishness that the Federal Reserve Bank of America representatives, led by Jerome Powell, signaled. They stated the bank is determined to raise American interest rates strongly until the American inflation, which has reached its highest level in 40 years, is contained.

Jerome Powell’s historic speech on Friday focused heavily on three key lessons for policymakers to draw from the Fed’s experience with inflation during the dark decades of the 1970s and 1980s, but he also offered a realistic assessment of the outlook for the U.S. economy as the bank tries to push inflation down from its highest levels in several decades.

“The restoration of price stability will take some time and requires the strong use of our tools to achieve a better balance between supply and demand. Lowering inflation will likely require a sustained period of flat growth. Furthermore, it is very likely that there will be some partial decline in the labor market,” said Powell, “While high interest rates, slow growth, and soft labor market conditions will lead to lower inflation, they will also cause some pain for households and businesses. And these are the unfortunate costs of reducing inflation. But the failure to restore price stability will mean much more,” he added.

Markets acknowledged widespread signs that the US economy is slowing. This is despite a clear warning against assumptions that the Federal Reserve could push back on raising interest rates further or start cutting them at some point in the first months of the new year.

The speech came as financial markets try to gauge whether federal policymakers will opt for a 0.75% sequential increase in the federal funds rate at the September meeting and amid much curiosity about how quickly the bank will raise borrowing costs to the “terminal” level during the following months.

June forecasts indicated the level was somewhere near the 4 percent handle and would likely be reached in the early months of 2023, but Chairman Powell reminded that those forecasts will be updated soon, and other federal policymakers have recently called for a steeper path.

In general, the gloomy economic outlook and the lingering upside risks regarding the path of the US interest rate in the future are some of the possible reasons why the initial dollar sales in the wake of Friday’s session did not last long, although not all observers share the same views.

Expectations of the USD/JPY:

- In the near term and according to the performance on the hourly chart, it appears that the USD / JPY currency pair has recently completed an upward breakout from the formation of a gently descending channel. This indicates the existence of a large upward wound in the short-term market sentiment.

- Therefore, the bulls will look forward to the extension of the current rise towards the resistance 137.91 or higher to the resistance 138.36. On the other hand, the bearish speculators will target short-term profits at around 137.07 or below at the 136.59 support.

- In the long term and according to the performance on the daily chart, it seems that the USD/JPY is trading within the formation of an ascending channel. This points to a large long-term upward wound in market sentiment.

- Therefore, the bulls will target the long-term profits at around 139.38 or higher at the 141.74 resistance. On the other hand, bears will look to pounce on profits at around 134.99 or lower at 132.52 support.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]