[ad_1]

If they do change the attitude in Washington DC, it is possible that we could see this market turn back around.

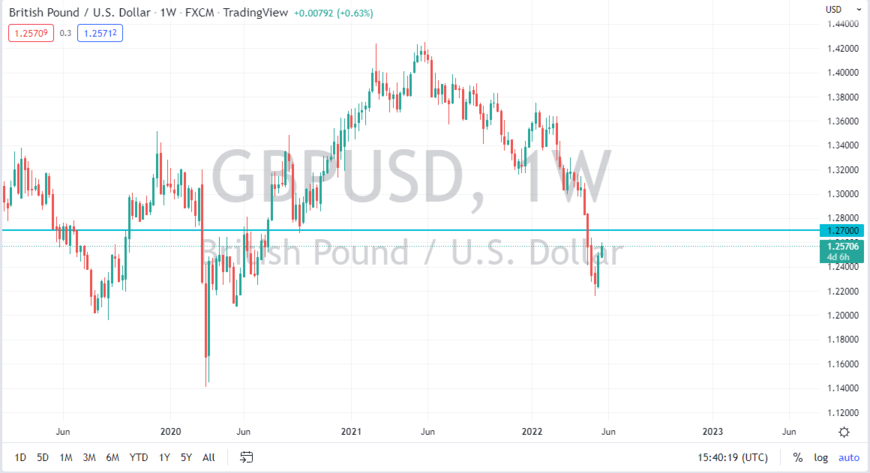

The British pound recovered later in the month of May, but it is still a currency that has been very soft overall. The 1.22 level has offered a significant amount of support that caused a bit of a bounce, but really at this point, I think the British pound is setting up for yet another selling opportunity. The 1.27 level has been an area where we have seen both support and resistance, so I do think that might be a bit of a “decision point.”

The 1.22 level will more likely than not be targeted again, especially if we get some type of major “risk-off scenario”, which would drive the US dollar much higher. The US dollar will be used as a safety currency, and the Bank of England is doing itself no favors, suggesting that although inflation is a bit of an issue, they are nowhere near as aggressive as the Federal Reserve. As long as that is going to be the case, it makes a lot of sense that sellers will jump in and start selling every time they get an opportunity. This is a market that not only reaches the 1.22 level, but then breaks down to the 1.20 handle.

If we were to break above the 1.27 level, then I think the British pound may attempt to get to the 1.30 level, but that is an area that I think will be very difficult to overcome, at least not unless there is some type of major pivot when it comes to the Federal Reserve and its attitude. If they do change the attitude in Washington DC, it is possible that we could see this market turn back around. However, the Federal Reserve does not look likely to be anywhere near doing so, so we need to pay close attention to Federal Reserve speakers. After all, inflation is a major issue, but if inflation starts the slowdown in the United States, that could be the beginning of the end of US dollar strength. Pay attention to the rate of change when it comes to CPI, PPI, and PCE indicators. If they also start trending down at the same time, and in other words make a “lower high”, then it might have traders looking to dump the greenback.

[ad_2]