[ad_1]

Sterling remained weak against the euro, dollar, and other currencies early this week after Bank of England Governor Andrew Bailey reminded financial markets of what is increasingly an uncertain bank rate outlook. Sterling was healing wounds after coming under pressure following earlier comments from Bank of England Governor Andrew Bailey in a discussion on macroeconomics and financial stability at Bruegel, an economic policy think tank. In the case of the GBP/USD currency pair, it retreated to the support level of 1.3051 before settling around the 1.3100 level at the time of writing the analysis.

Bank of England Governor Bailey said the significant pressure on income from recent increases in the prices of commodities and other commodities is on par with what we have seen in any one year from the 1970s and stated that this could reduce the extent to which interest rate hikes are needed further. “We are facing a very big shock by all historical standards,” he said. We’ve got a pretty big trade-off between inflation, production and activity, with the two moving in opposite directions. And “there is a very high level of uncertainty.”

He added, “The point I want to make here is that in these circumstances, forward-looking policy guidance should be aware of the uncertainty we face and the risks we face, and with that really in mind, we changed our language in our last meeting to state that more Of modest emphasis it may be appropriate ‘instead of’ is likely to be fitting ‘as we have used before’.

While expectations for the bank rate were later dampened following the Bank of England’s March policy statement, pricing in the swap market (OIS) still implied on Monday that another increase in the bank rate from 0.75% to 1% is uncertain. “There is only one expectation that I can safely make and that is that there will be a meeting in May,” the governor added.

Financial market prices also envisage a bank rate hike to 2 per cent or more before the end of the year, an assumption that will likely be pressure tested in the near future if the BoE’s latest language and the governor’s comments on Monday are anything to follow. The Bank of England said on March 17 that inflation was likely to reach 8% by April and warned that this could dampen demand from some parts of the economy, while Governor Bailey said on Monday that this dynamic could eventually reduce domestically produced inflation.

Governor Bailey’s recent comments and BoE language mean that the next round of economic forecasts will be doubly important, especially whether or not inflation drops further below the 2% target at the end of the forecast horizon. The latter could lead to commodity pressure on income being seen as a proxy for some of the interest rate hikes that have all been transferred to the bank by the markets recently, and that will be why each of the BoE’s upcoming policy decisions poses two-sided risks to the pound.

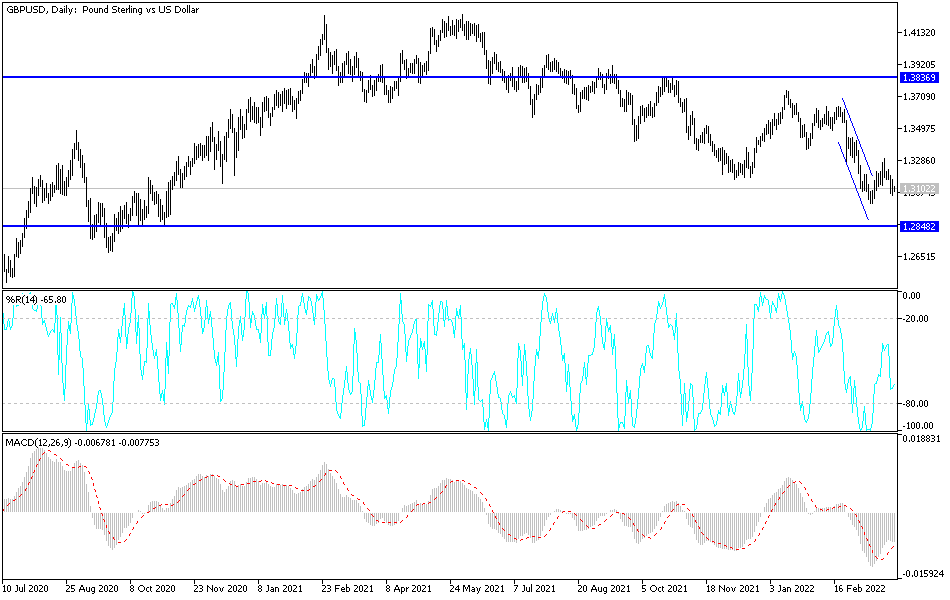

According to the technical analysis of the pair: On the daily chart, the price of the GBPUSD currency pair has turned bearish. The opposite bearish channel may appear clearly with the breach of the 1.3000 psychological support, which may bring the bears more movement to the bottom. Therefore, the next most important support levels may be 1.2920 and 1.2800 on the straight. On the other hand, there will not be a strong and continuous bullish momentum without the bulls moving towards the 1.3335 resistance. Today, the currency pair will be affected by the announcement of the growth rate of the US economy and the number of US non-farm payrolls from ADP.

[ad_2]