[ad_1]

The relative calm of August trading is likely to fully disappear in the coming days, as traders react to more nervous sentiment and the USD/ZAR could prove very choppy.

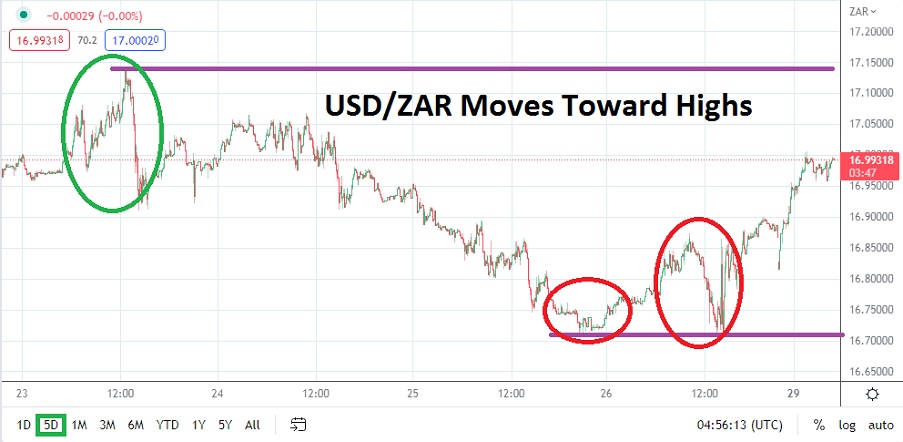

The USD/ZAR is trading near the 17.00000 level as of this writing, as bullish speculation gets plenty of consideration.

The USD/ZAR is trading within sight of the 17.00000 with active price action abundant. On cue in the midst of the storm created by Federal Reserve Chairman Jerome Powell on Friday, the USD/ZAR currency pair went from a low of nearly 16.71000 to 16.90000 without much hesitation. Via early transactions this morning the USD/ZAR has continued to move incrementally higher and is touching key psychological ratios near 17.00000.

17.00000 Could prove to be Lynchpin for Dynamic Movement in USD/ZAR this week

It may seem quite simple to say the 17.00000 is important psychologically, but having broken this ratio higher already in July and only last week, the USD/ZAR may start to create a group of ‘backers’ who believe the forex pair should be above this level fundamentally for the time being . Global market conditions remain nervous and last week’s Jackson Hole central bankers’ conference has done little to soothe the minds of financial houses.

Technically the 17.00000 has been punctured enough in recent memory to have created a framework of belief this level can prove vulnerable again. If the 17.00000 level is toppled and the 17.05000 mark begins to be flirted with it could set the stage for another round of dynamic speculative buying. Only one week ago the USD/ZAR touched the 17.13600 mark. And in July the USD/ZAR traded above 17.20000.

Traders need to be prepared for the Potential of a rather Turbulent Week in the USD/ZAR

- The relative calm of August trading is likely to fully disappear in the coming days, as traders react to more nervous sentiment and the USD/ZAR could prove very choppy.

- Global conditions in Forex remain intense as a strong USD causes problems with a handful of emerging market currencies; the USD/ZAR is reflecting this whirlwind of results as it tests highs.

Speculators should not be overly ambitious in the short term. Quick hitting trades which look for realistic targets may prove to produce the best results in the near term. If sustained trading takes place above the 17.00000 level this will spark intrigue for the USD/ZAR and could allure more bullish sentiment.

However, the USD/ZAR will need to sustain value above the 17.14000 ratio in order to build a strong surge higher which then tests July’s highs. If the USD/ZAR were to stumble to the 16.93000 to 16.87000 ratios it may be tempting as a place to ignite buying positions based on the notion more upside price movement will occur.

USD/ZAR Short Term Outlook:

Current Resistance: 17.04900

Current Support: 16.93200

High Target: 17.15800

Low Target: 16.81000

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]