[ad_1]

The only thing I think you can count on at the moment is going to be a lot of noise, as we are reentering the area that had been so important previously.

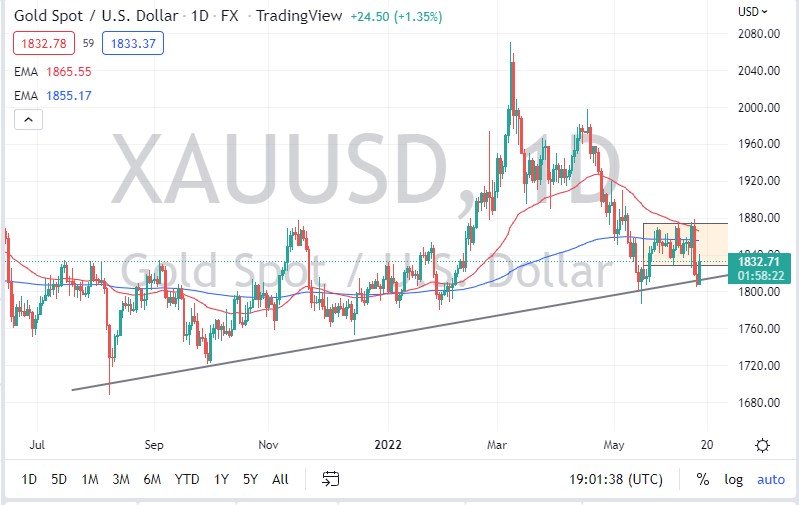

Gold markets bounced a bit on Wednesday as the Federal Reserve announcement has come and gone. With the Federal Reserve raising interest rates by 0.75%, it seems like the market was satiated for the time being. At this point, the market has been noisy for a while, so the fact that we ended up forming a major green candle does suggest that perhaps we are trying to put together a “double bottom.”

The uptrend line is something that people pay attention to as well, and of course, the $1800 level should be paid close attention to. At this point, it looks as if the gold market is going to continue to see a lot of noisy behavior, but at this point, I think short-term pullbacks will offer buying opportunities, but you need to pay close attention to inflationary expectations, and it is probably worth noting that we are going to have to pay close attention to the 200-day EMA at the $1855 level.

However, if we were to break down below the $1800 level, then it would be an opening to the downside, possibly breaking down to the $1700 level. That would be a major move in the US dollar just wait and happen, so I’m looking at this through the prism of the anti-US dollar and of course the interest rate situation. The only thing I think you can count on at the moment is going to be a lot of noise, as we are reentering the area that had been so important previously. Ultimately, this is a market that I think continues to see a lot of noisy behavior, so keeping a smaller position is a good way to keep yourself from being shaken out, as it would be very easy to have that happen. The 50-day EMA is starting to break down to the 200-day EMA, which in theory could open up the possibility of a move to form the “death cross”. Either way, I think you got a lot of back-and-forth at this point, and you should treat it as such. If we were to break above the $1880 level, then gold almost certainly will take off to the upside, perhaps reaching to the $1900 level, followed by the $2000 level longer-term.

[ad_2]