[ad_1]

Spot natural gas prices stabilized at a decrease in the recent trading at the intraday levels, to achieve slight daily gains until the moment of writing this report, by 0.12%. It settled at $7.740 per million British thermal units, after declining during yesterday’s trading by It reached -4.46%.

Yesterday’s Nymex September contract for natural gas fell 47.5 cents to $7.589 per million British thermal units on Monday. October futures contracts were down 47.3 cents to $7.578.

Spot gas prices NGI’s Spot Gas National Avg also fell across most of the US although the sweltering heat continued for another day or so to lose about 20.0 cents to $7.845.

The latest weather models have shown that cold weather will start this week for most of the month in most of the US, so domestic demand will not be as strong as it has been in the past six weeks.

Meanwhile, US production hit an all-time high of 98 billion cubic feet per day last week, and settled near that level early Monday. The supply-to-demand balance may already be showing signs of slackening based on the latest inventory data. Any cooler weather on the horizon could lead to a further decline in the near term.

Technical Analysis

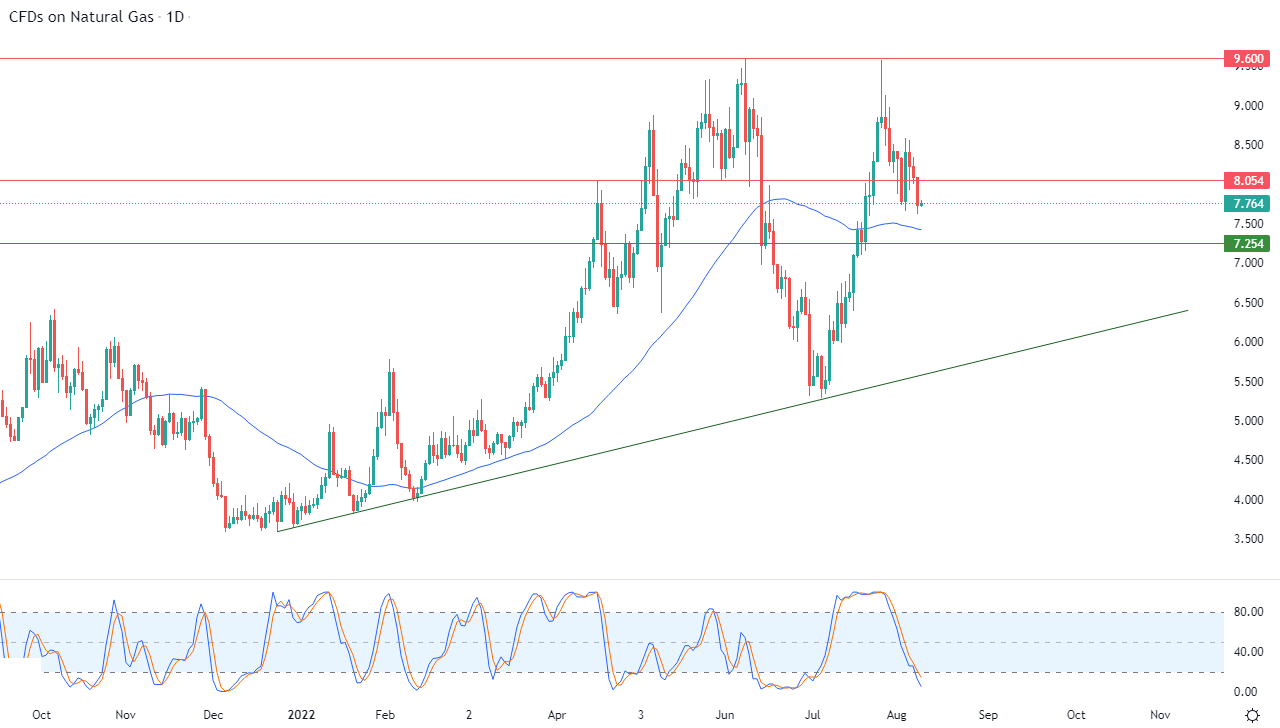

Technically, the main bullish trend in the medium term and along a slope line dominates the natural gas trading movement, as shown in the attached chart for a period of time (daily), and it is also supported by its continuous trading above its simple moving average for the previous 50 days. In addition to that, we note the arrival of relative strength indicators to areas that are very oversold in selling operations, and exaggeratedly compared to the price movement, which suggests the beginning of a positive divergence in them, so that the price is trying in its recent trading to search for a bullish bottom to take as a base that might help it gain positive momentum to help it recover and rise again.

Therefore, we still expect the rise of natural gas to return during its upcoming trading, provided that the support level 7.254 remains intact, especially if its stability returns above the resistance level 8.054, after which it will target the pivotal resistance level 9.600.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.

[ad_2]