[ad_1]

Spot natural gas prices (CFDS ON NATURAL GAS) stabilized at a decline in recent trading at intraday levels, to achieve slight daily gains until the moment of writing this report, by 0.96%. It settled at the price of $9.372 per million British thermal units, after sharply declining during trading. Yesterday, the rate was -5.24%.

Trading is risky. While EURUSD and GBPUSD spreads will be at zero for most of the time on the ECN account, FXTM cannot guarantee spreads will remain at zero at all times.

Natural gas prices retreated from 14-year highs after Freeport LNG said on Tuesday it plans to restart its liquefaction facility in early to mid-November, later than previously expected, and that will lead to further delays. in US LNG exports.

Higher natural gas prices in Europe helped keep prices higher around the world, prices in Europe rose on Monday after Russia announced that natural gas giant Gazprom would again halt supplies to Europe via the Nord Stream 1 pipeline for three days. It starts on August 31.

However, natural gas storage facilities in Germany are now more than 80% full before winter, showing steady progress despite a significant drop in deliveries from Russia amid the war in Ukraine.

Natural Gas Technical Outlook

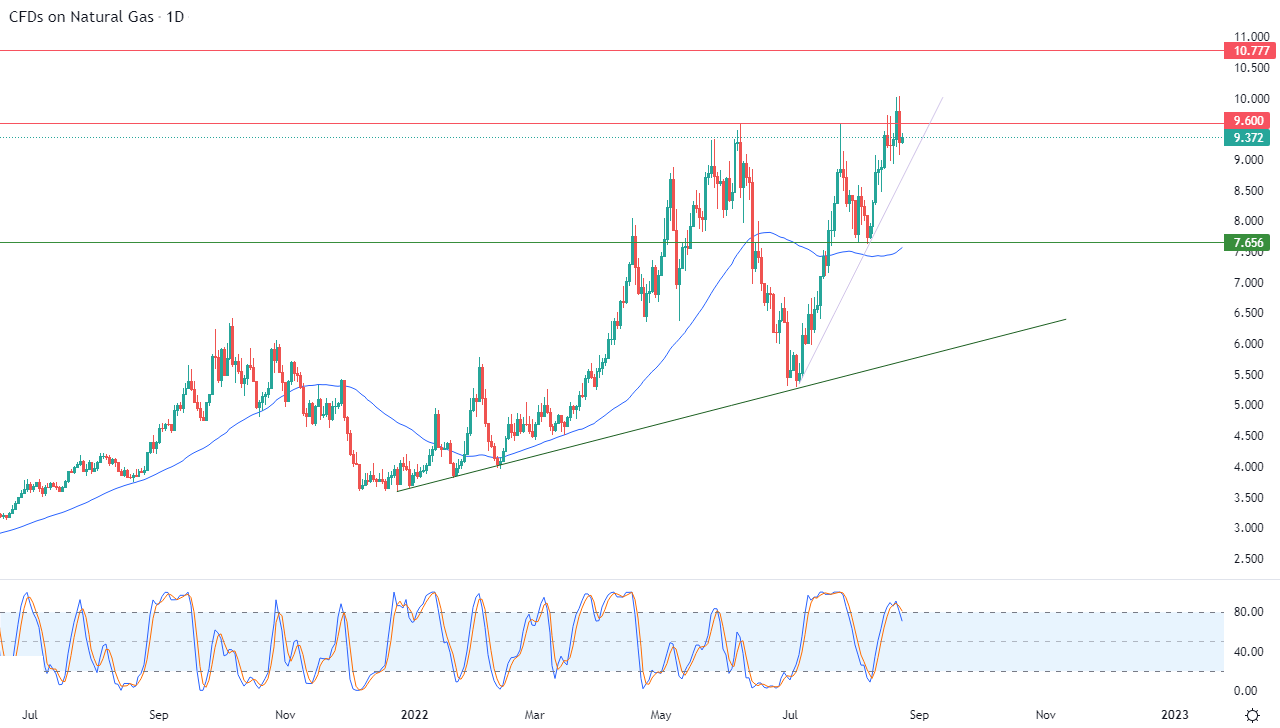

- Natural gas declined following the stability of the pivotal resistance level 9.600, as the price failed to confirm its breach with another close above.

- It reaped the profits of its recent rises, and to try to gain positive momentum that might help it recover and breach that resistance in the future.

- It is trying at the same time to drain some of its saturation of clear buying of the relative strength indicators, especially with the start of the influx of negative signals from them.

All of this comes in light of the dominance of the main bullish trend over the medium and short term along a slope line, as shown in the attached chart for a (daily) period, with the continuation of positive support for its trading above its simple moving average for the previous 50 days.

Therefore, our expectations suggest a return to the rise of natural gas during its upcoming trading, but on condition that it first breach the pivotal resistance level 9.600, then target the resistance level 10.70. In the event that this resistance continues to remain stable in front of its upcoming trading, this would lead to more negative pressure to target the support level. 8.60.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.

[ad_2]