[ad_1]

The recent trading sessions are characterized by the presence of a strong and sharp struggle between bears and bulls to determine the direction of gold. The price of the yellow metal is in a range between the level of $ 1857 an ounce and the level of $ 1835 an ounce. The gold market awaits strong stimuli to determine the path, and the reaction may be to the statements of US Central Bank Governor Jerome Powell, the strongest influence on the US dollar, and therefore the price of gold. The price of gold is still looking for catalysts to rise in the face of the pace of raising interest rates from global central banks.

Last week, the Federal Reserve raised the US short-term interest rate by three times the usual amount for its largest increase since 1994. It may consider another huge increase at its next meeting in July. Last week’s report on the US economy also showed that industrial production was weaker last month than expected. Markets are preparing for a world with higher interest rates, led by the actions of the Federal Reserve. Higher rates can bring down inflation, but they also risk triggering a recession by slowing the economy. It also tends to hurt the price of stocks, cryptocurrencies, and other investments.

Accordingly, testimony on monetary policy by Federal Reserve Chairman Jerome Powell before the Senate Banking Committee and the House Financial Services Committee is scheduled for later this week.

Generally speaking, two of the three largest economies in the world, namely China and Japan, do not engage in raising interest rates, unlike the US Federal Reserve and central banks in many other countries. Fears that the global economy could slide into recession if planners push forward aggressively with higher interest rates and other moves to tighten monetary policy have sent markets tumbling after stock prices surged thanks to massive support during the pandemic.

Last week, the BoJ stuck to its near zero interest rate policy despite concerns about a weak yen.

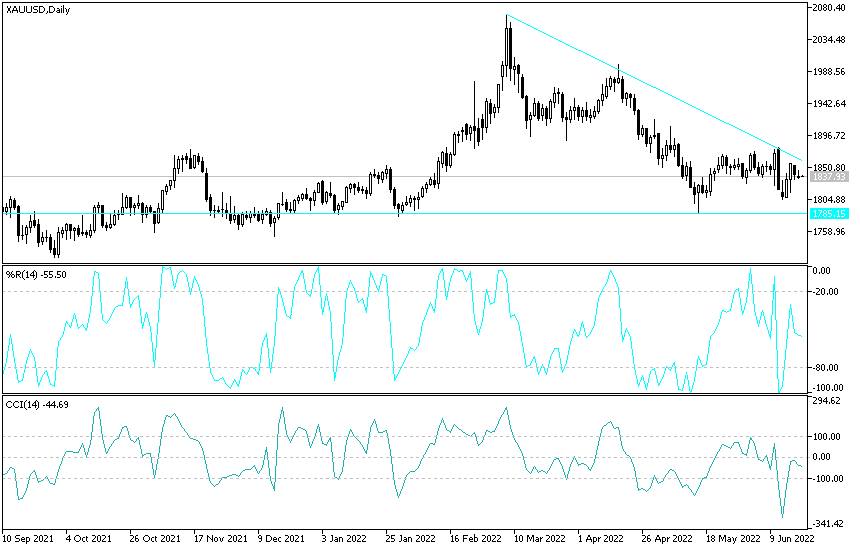

According to the technical analysis of gold: the price of gold and according to the performance on the daily chart is still in a neutral area. The tendency will be to the downside if the investors move to the support levels of 1825 and 1810 dollars, respectively. I still prefer the trading strategy for the price of gold by buying from every bearish level, especially if it moves to break the $1800 support again. The price of gold may remain under pressure until the reaction from the testimony of US Federal Reserve Governor Jerome Powell this week.

Increasing global geopolitical tensions, fears of a global economic slowdown and the suspension of the US dollar from making gains may motivate the gold price to rise towards the resistance levels of 1855 and 1878 dollars, respectively, which are levels that stimulate the bulls’ control of the yellow metal market.

[ad_2]