[ad_1]

With more than 300 pips, the price of the USD/JPY currency pair moved upwards from 122.00 to the resistance level 125.10, the highest in six years. This came in light of the Japanese economy’s faltering recovery from the effects of the epidemic and the consequences of the Russian-Ukrainian war. The USD/JPY currency pair has returned to stabilize around the 123.30 level at the time of writing the analysis. Yesterday, the Bank of Japan offered to buy an unlimited amount of 10 year JGBs after yields rose to the upper end of their target range.

In a statement on Monday, the BoJ said it will buy an unlimited amount of 10-year Japanese government bonds at 0.25 percent for three consecutive days beginning on March 29. Earlier, the Bank of Japan made unlimited purchases of Japanese government bonds by 0.25 percent on February 14.

Despite the intervention, yields on government bonds continued to rise against the hawkish stance of the US Federal Reserve. The 10-year Japanese government bond yield rose to 0.24% on Monday and the Japanese yen fell to a six-year low against the US dollar.

Japanese Prime Minister Fumio Kishida has called for measures to mitigate the impact of higher energy prices, which are amplified by the depreciation of the Japanese yen, as he looks to maintain popular support ahead of the summer elections. Finance Minister Shunichi Suzuki said that Kishida ordered the compilation of moves at a cabinet meeting on Tuesday. While the prime minister’s approval ratings remain in good shape despite Japan’s worst wave of virus infections, growing discontent over the fastest-rising fuel and electricity bills in 41 years threatens to change the optics over the coming months.

Unwilling to join a long list of Japanese leaders in the short term, Kishida is eager to show he is taking action. It also needs to strike a delicate balance to ensure real relief for households and businesses when needed, without giving the impression of a dispersal of spending. Kishida has already floated 360 billion yen ($3 billion) in measures to offset the surge in crude prices in March. Under the current aid, the government is currently paying oil refiners a subsidy of 18.6 yen (15 cents) per liter of gasoline, up from a previous 5 yen subsidy introduced since January.

While oil prices are down from the highs seen earlier in the war in Ukraine, volatility remains high and a sharp slide in the yen will keep upward pressure on imported fuel costs. The yen briefly crossed the 125 dollar barrier on Monday for the first time in seven years.

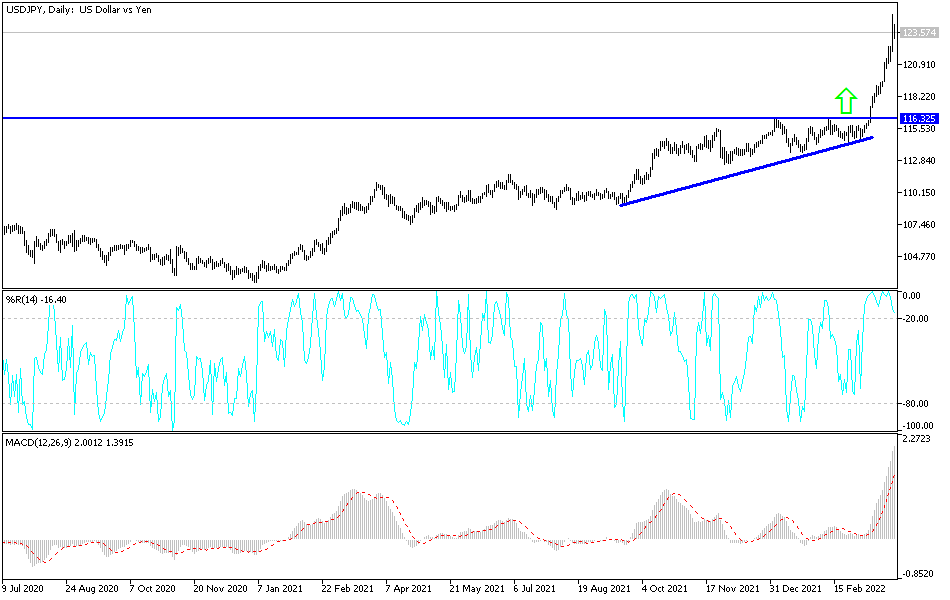

According to the technical analysis of the pair: The gains of the USD/JPY currency pair stopped, but it did not take it out of the upside trend, which is still valid. As mentioned before, and according to the performance on the daily chart, there will be no exit for the pair from its current channel without the bears moving towards the 118.50 support level. The stability is above the resistance psychological 120.00 motivates the bulls to move further higher. At the same time, it must be taken into consideration that the recent gains were a catalyst for the technical indicators to move towards strong overbought levels, and if the pair did not gain momentum, it may be exposed to profit-taking at any time.

The dollar yen currency pair will continue to interact with the market’s expectations regarding the future of raising US interest rates and the extent to which investors take risks or not, and today it will interact with the US consumer confidence reading.

[ad_2]