[ad_1]

Inflation tends to show up in energy rather quickly, so would not be a huge surprise to see this market rally and eventually break out.

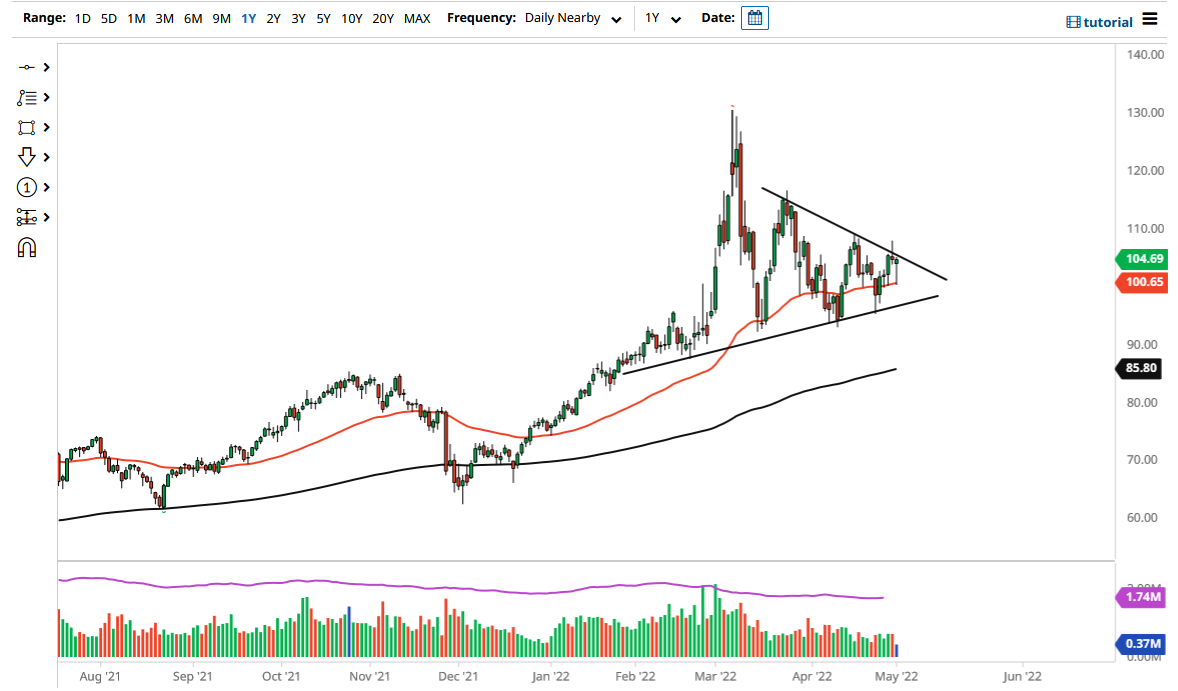

The West Texas Intermediate Crude Oil market fell initially on Monday to reach down to the 50-day EMA. By doing so, it started to show that we are going to continue to pay close attention to this triangle that I have drawn, but I think it still has more of an upward bias to it at this juncture. Unfortunately, it is not just about supply and demand, but it is about rumors and speculation when it comes to headlines as well.

As long as there is a war in Ukraine and the sanctions that come with Russian oil, it is going to cause a lot of headaches. Germany has suggested that perhaps they are going to completely abandon Russian oil altogether, so that may have been what caused the turnaround in the middle of the session. The market falling to the 50-day EMA does make sense because you can see that it has been at least vaguely following the trajectory of that indicator. Keep in mind that in three of the last four days, the market has touched the 50-day EMA.

The Friday candlestick was the outlier in that situation, initially breaking through the triangle but giving back the gains to form a massive shooting star. While bearish, you can also make a strong argument that a lot of traders will not have wanted to carry risk heading into the weekend. Regardless, if we can break above the top of the shooting star from the Friday session, that would suggest that crude oil was about to go much higher.

Inflation tends to show up in energy rather quickly, so would not be a huge surprise to see this market rally and eventually break out. Furthermore, there is also the noise coming out of global demand. While the supply issues continue to be obvious, where people were not paying as much attention is the fact that some figures such as Chinese PMI have been falling through the floor. Yes, I realize they have a lockdown in China going on with a huge portion of the population, but that would only reiterate the demand slowdown argument. All you can do at this point is follow the charts. If we break that shooting star to the upside, you have to assume that we continue going higher.

[ad_2]