[ad_1]

Even with the prospect of a big interest rate hike by the European Central Bank in September rising, the euro has struggled as the bloc’s energy crisis increases recession risks.

Every time the price of the EUR/USD tries to rebound upwards, the negative impact factors remind investors that the euro will remain weak for a longer period of time.

At the beginning of this week’s trading, it tried to bounce upwards, but its gains did not exceed the level of 1.0030 and then returned to stability around the parity price again, before the announcement of the German inflation figures and the American consumer confidence reading.

At the beginning the week, the US dollar rose to the highest level in 20 years against the other major currencies after Federal Reserve Chairman Jerome Powell indicated that US interest rates will remain high for a longer period of time to reduce rising inflation. Accordingly, the US dollar index DXY, the measure of the US currency against a basket of major currencies, rose to the highest level of 109.48 in two decades.

On the other hand, the euro remained weak near its lowest level in 20 years, even with the tough statements of the European Central Bank, which strengthened the expectations of an interest rate hike in September.

At the end of last week, Powell told the central banking conference in Jackson Hole, Wyoming, that the Federal Reserve will raise US interest rates as high as needed to restrain growth and will keep them there “for some time” to lower the 2% inflation target, which is more than three times the Fed’s rates.

“Powell’s comments supported pricing a higher rate on federal funds for a longer period of time,” said Kenneth Brooks, a currency analyst at Societe Generale Bank, “the assumption that the Fed will start cutting interest rates in mid-2023 is premature,” he added.

The capital markets responded by intensifying bets for a sharper hike in US interest rates in September, with the probability of a 75 basis point hike currently at around 70%. Accordingly, US Treasury bond yields rose, with two-year bond yields reaching their highest level in 15 years at around 3.49%, which strengthened the US dollar. In his speech at the Jackson Hole Symposium, European Central Bank Board Member Isabelle Schnabel, French Central Bank President Francois Villeroy de Gallo and Latvia’s Central Bank Governor Martins Kazak all called for strong or important political actions.

Even with the prospect of a big interest rate hike by the European Central Bank in September rising, the euro has struggled as the bloc’s energy crisis increases recession risks. It is expected that the giant Russian energy company Gazprom will stop natural gas supplies to Europe from August 31 to September 2 due to maintenance.

Overall, the EUR/USD exchange rate has fallen significantly in 2022, and although factors such as the US economy and Fed policy have been an important driver of this decline, it is the rising cost of energy supply disruptions that gives most credence to bearish forecasters for some the other markets. Regarding the expected future for the Euro-Dollar, both “Rabobank” and “Nomura” expected a sustained break below the parity price in the Euro/Dollar rate during the coming months.

Expectations of the EUR/USD:

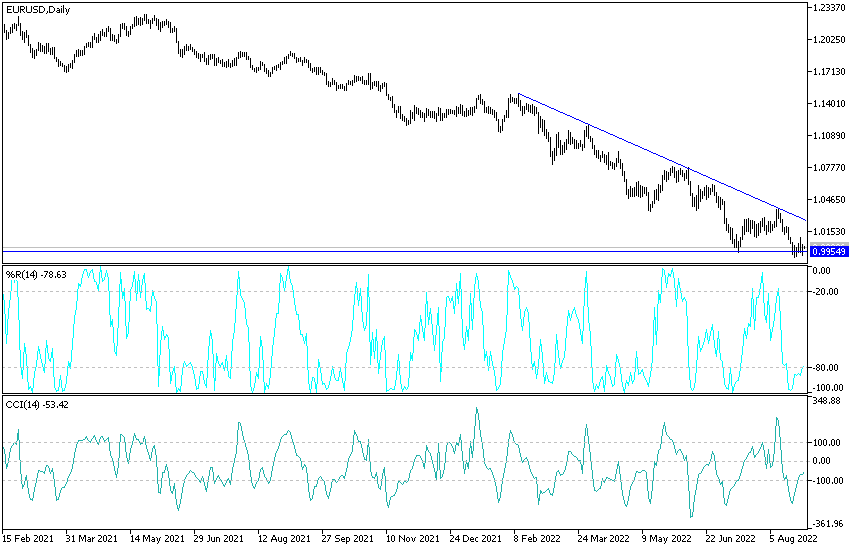

- The general trend of the EUR/USD currency pair is still downward and the stability below the parity price supports the bears’ control over the trend for a longer period of time.

- The continued concern about the future of energy in the Eurozone will stimulate the bears to further move down and therefore the appropriate support levels for the currency pair may currently be 0.9920 and 0.9845 and 0.9790 respectively.

- On today’s chart, the current performance pushed the technical indicators towards oversold levels.

On the upside and in the same period of time, breaking the 1.0200 resistance pair of the euro will be an opportunity to break the downward trend. Today the euro will react to the announcement of the German inflation figures and the dollar will react to the announcement of the American consumer confidence reading.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]