[ad_1]

There is no change in my technical view for the performance of the GBP/USD pair.

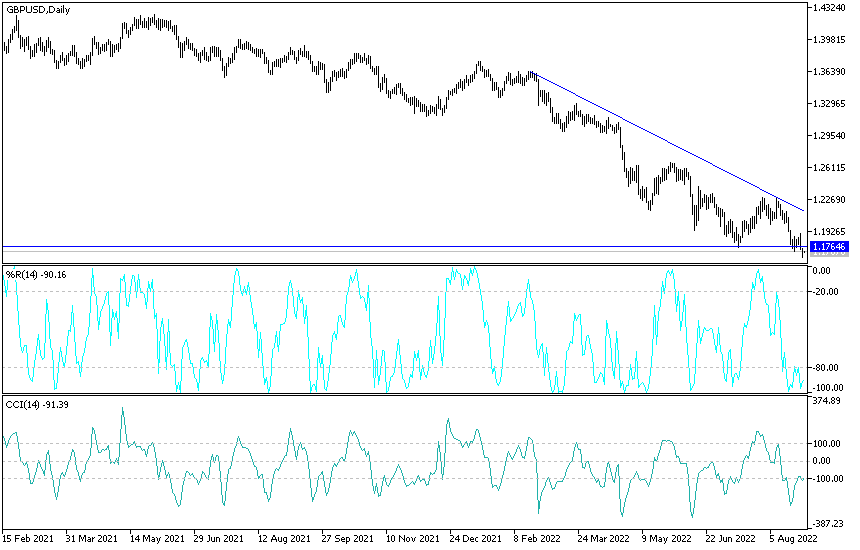

- At the beginning of this week’s trading, and despite the holiday in Britain, the price of the GBP/USD currency pair fell to a stronger support level, towards 1.1648, its lowest since the height of the market crash in 2020. It settled around the 1.1700 level at the beginning of trading today, Tuesday.

- The US dollar is still the strongest against everyone with expectations of a strong raise of the US interest rates in the coming months to contain US inflation, which has reached its highest level in 40 years.

- The sterling faces strong expectations of a British economic recession and the uncertainty of the political future in the country to choose a new prime minister.

Federal Reserve Chairman Jerome Powell delivered a stark warning on Friday about the Fed’s determination to fight inflation by raising US interest rates further: it will likely cause pain to Americans in the form of a weak economy and job losses. The message arrived with a heavy blow to Wall Street markets, sending the Dow Jones Industrial Average down more than 1,000 points on the day.

“These are the unfortunate costs of lowering inflation,” said Powell in a high-profile speech at the Federal Reserve’s annual economic symposium in Jackson Hole.

Investors had been hoping for a signal from Powell that the Fed may adjust US interest rate hikes soon later this year if inflation shows more signs of abating. But the Fed chief indicated that time may not be soon, and stocks have fallen in response.

Runaway price hikes have left most Americans nervous about the economy, even as the unemployment rate has fallen to a half-century low of 3.5%. It also caused political risks for US President Joe Biden and congressional Democrats in the fall elections, as Republicans decried Biden’s $1.9 trillion financial support package, approved last year, as driving up inflation.

Some on Wall Street expect the US economy to fall into recession later this year or early next, after which they expect the Federal Reserve to reverse itself and cut interest rates. However, a few Federal Reserve officials have opposed this idea. Powell’s comments suggest that the Fed aims to raise the benchmark interest rate – to about 3.75% to 4% by next year – but not so high that the economy falters, hoping growth slows long enough to conquer high inflation.

GBP/USD Forecast:

There is no change in my technical view for the performance of the GBP/USD pair. The general trend is still bearish and stability below the 1.2000 psychological support motivates the bears to move further down, amid clear ignoring the movement of the technical indicators on the daily chart to oversold levels.

There will be no chance for the sterling to recover for a while without sudden indications from the Bank of England, which is determined to raise interest rates with no fear of economic recession. According to the performance on the daily chart, breaking the resistance 1.2080 is important for the bulls to launch and change the direction, even for a short time.

On the downside, the general trend is the strongest so far, the closest support levels for the currency pair are 1.1640, 1.1580 and 1.1500, respectively. After returning from a British holiday, money supply figures, net lending to individuals and mortgage approvals will be announced. From the United States, the US consumer confidence and the number of job openings will be announced.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]